How Much Money Do You Really Need to Borrow?Before getting too deep into the process of a huge business loan, ask yourself these three tough questions.

ByAmi Kassar•

Opinions expressed by Entrepreneur contributors are their own.

Many think fast and furious is the right way to grow a company business, but it's often not the smartest mentality when it comes tobusiness loans.

小企业主和创业者需要钱狗万官方for a variety of reasons, but many are unrealistic about how much money they really need. The point of a loan should be to help your business get to the next level, not the next ten levels. It's also not a substitute for generating income or a permanent crutch -- people that see it as such are likely in much more trouble than they realize when contacting a loan broker.

Before getting too deep into the process or too excited about the prospect of a huge business loan or SBA loan, take a step back and ask yourself these questions:

- Will you make enough income from the loan to be able to comfortably pay the loan back over time?

- Do you understand the financing options? Protect your business by reading all terms carefully andbe awareof the price you pay for "quick and easy" loans.

- What are your goals for the next year? Know your business plan and where your venture is realistically headed in the future to protect it from other unnecessary expenditures.

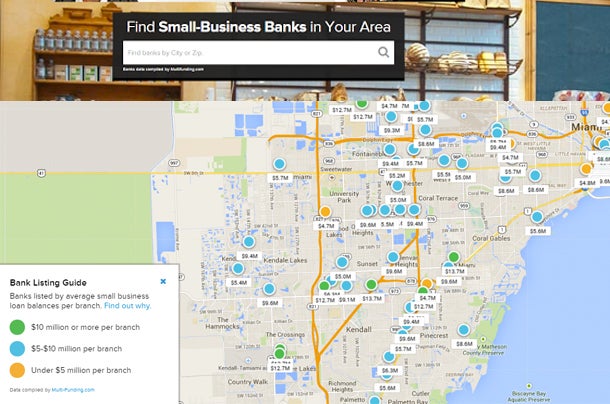

Related:Entrepreneur Bank Search -- A search tool to help you discover local banks.

A serious reality check is vital for entrepreneurs of all business stages. But because many are risk takers and dreamers by nature, small-business owners often let visions of grandeur cloud their judgment when considering how much money to borrow, thinking they need a warehouse of their own, machinery and materials at the ready, a marketing and PR guru to help propel their business. Most of these assets are not immediate or crucial stepping stones to launching a business.

For instance, a business owner who makes a niche product would likely be better off finding a co-packing facility and looking for funding based on purchase orders than seeking out millions to build a facility. The dream for the facility is there, but the need for it is not. There is often a better, and cheaper, way to solve a problem.

As the founder ofMultiFunding, a Pennsylvania-based loan advisory, I meet many entrepreneurs who think that a loan is magical money that can be paid back whenever they start turning a profit. The shock of potentially high interest rates and short amortization periods can creep up on business owners before they even realize that payments are due. In reality, you may need to start making loan payments before the fruits of your labor have fully started yielding a profit. The decision to take out a loan, and how much money to take, is not a decision that should be made over a cup of coffee.

Instead, thinking long, hard and insmaller stepslifts the financial burden and often results in more success than being convinced that it's all or nothing.

Related:The Small-Business Guide to Getting the Cash You Need