When Sitting With More Than 30% Loss In Current Market Crisis, Don't Make These MistakesMarket corrections are best times to capitalize on opportunities that could lead to significant wealth creation in the long run.

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur India, an international franchise of Entrepreneur Media.

The Coronavirus pandemic has dealt a big blow to economies across the globe and consequently stock markets have suffered huge losses. Stock market corrections have led to investors losing trillions of dollars in their investment portfolios and although in the last couple of day's equity markets have seen some major pull backs, the volatility around these wild gyrations have had investors confused as to what their investment strategy should be going forward.

The most common question that comes to an investor's mind given the turbulence is that whether he should exit now and minimize losses or stay put, and most often, in the absence of sagacious advice, investors make mistakes that are detrimental to their investment plans of long-term wealth creation.

Common Mistakes

Panic Selling

The most common hypothesis in the equity markets to generate optimal returns is to predict the tops and bottoms and sell or buy accordingly. However, in reality, even the most talented fund managers are unable to do so; at best their goal is to exit as close to the top as one predictably can and to enter into new positions closer to the bottom.

普通投资者的实际结果是前女友actly the opposite, retail investors have a propensity to enter the stock markets at their peaks and exit when the so-called elusive bottom is near.

In times of sharp market corrections, it is widely seen that investors run out of patience and often panic and in desperation sell off all their holdings and book their losses. This is the worst thing one can do to their investment portfolio and should be avoided at all costs; market corrections are a time to re-evaluate one's portfolio and to look at each and every stock objectively. Fundamentally strong stocks in an investment portfolio should never be liquidated but rather, market correction is an opportunity to average down and accumulate good quality stocks.

Changing Investment Strategy

Investors should not get distracted by market volatility and try to charter on a new path and try out a new investment strategy. A common mistake that investors make during market corrections is to jump into bad quality stocks just because they have lost significant value. Rather than buying a stock just because it looks cheap, one should analyze the reasons behind the steep decline and buy only if the decline in unjustifiable.

Another mistake that investors make during downturns is by getting extremely cautious and liquidating stocks with high return potentials and getting into safer names which are unable to generate higher returns in the long term.

In other instances, investors who otherwise have a longer-term outlook on the stock markets turn into day traders in an attempt to capitalize on market volatility but eventually get sucked into the volatility vortex and incur huge losses in the process. The bottom-line therefore is that one should always stick to their investment strategy which is tailored to individual risk tolerance, market corrections are opportunities to rejig and rebalance rather than making wholesale changes into one's investment portfolio.

Advice

Stick To Fundamentals And Stay For Long-Term

While unlike the past market crashes, the root of the current crash is not economic, the wealth destruction it would lead to in the short-term will play out exactly the same way it has played out in previous crises. In bad times, typically fundamentally strong businesses sail through and reach the shore safely, while weaker businesses sink. Better run companies will be able to withstand the turbulence and bounce back quickly; therefore, it makes more sense to stick with fundamentally strong and proven businesses in turbulent times.

Investing should be for the long haul and one should not react based on one-week, one-month or one-quarter performance. For instance, between May 2008 and February 2009, the S&P 500 lost nearly half of its value, but within one year it bounced back, consequently leading to significant returns to the investors who stayed invested or made fresh investments during the crisis. In the five years that followed, the S&P 500 climbed more than 153 percent.

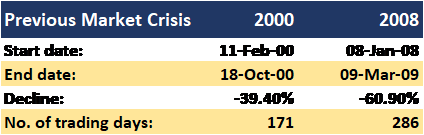

The following two graphics depict the two major stock market corrections and the returns post crisis

The key is to stay invested with a long term horizon into quality names with strong fundamentals because these stocks are the real wealth creators for the investors.

If You Have Cash, Its Best Time To Invest in Equity Markets, But Don't Try To Catch Market Bottom

Equity markets offer superlative returns across asset classes in the long term, therefore this is not the time to invest fresh capital into other asset classes, if one has some available liquidity. Other asset classes such as real estate, gold although would act as a hedge in the short term but would not be able to match the returns of the equity markets as the market is currently trading at a discount. This would perhaps be the right time to deploy fresh capital in good quality stocks or average down into fundamentally strong positions if you are already invested. This is the time to deploy a lump sum in phases in addition to any other systematic investment plan (SIP) into equity markets that one may already have. Do not commit your cash in one go, rather a staggered entry which is spread over several months is ideal. In doing that, you may not be able to capture the swing in its entirety, but will certainly avoid getting whipsawed by sucker rallies. The key to success remains in investing small chunks at regular intervals and avoiding the desire to catch a bottom and thus failing to deploy fresh capital altogether.

Ignore Short-Term Volatility and Don't Review Portfolio Every Day:

At times of market turmoil and volatility, looking at your portfolio performances daily may be potentially detrimental to your investment portfolio. Panicking over your unrecognized losses and consequently liquidating significant portions of your investment portfolio could lead to irreparable losses. Finding your portfolio take a knock every day will lead you to question your investing choices that could result in you making investment choices that may be totally unnecessary. Any review you undertake at this stage should be purely from an asset allocation perspective. If the asset mix has changed substantially from desired levels, rebalance portfolio to its original shape, leave the microscopic review for a later time.

Conclusion

投资者应该检查错误并重新上市frain from making them; market corrections are best times to capitalize on opportunities that could lead to significant wealth creation in the long run. Investors should therefore stay invested in good quality stocks during turbulent times and if possible leverage this opportunity by either averaging down into quality names or deploying fresh capital to good quality stocks that have been beaten down due to the market turmoil.